How your commercial property insurance may be impacted by continual social distancing & lockdown rules.

Ordinarily, commercial and domestic properties become unoccupied for a variety of reasons. The predominant reason for the current sharp rise in unoccupied buildings is of course due to social distancing rules.

The risks associated with unoccupied and occupied properties differ; due to underwriter attitudes, it is notoriously difficult to insure an empty building.

WHY ARE ATTITUDES DIFFERENT TOWARD

UNOCCUPIED AND OCCUPIED PROPERTIES?

Unoccupied properties are vulnerable due to increased risk of the following:

• Arson

• Vandalism

• Squatters

• Lack of maintenance (leading to further losses)

• Undetected long term damage (eg leaking pipes)

• Theft (many claims are for stolen radiators)

From the insurers perspective leaving a building empty means the ‘risk has changed. To stay adequately insured it is imperative you check your insurer’s policy wording and communicate the occupancy change.

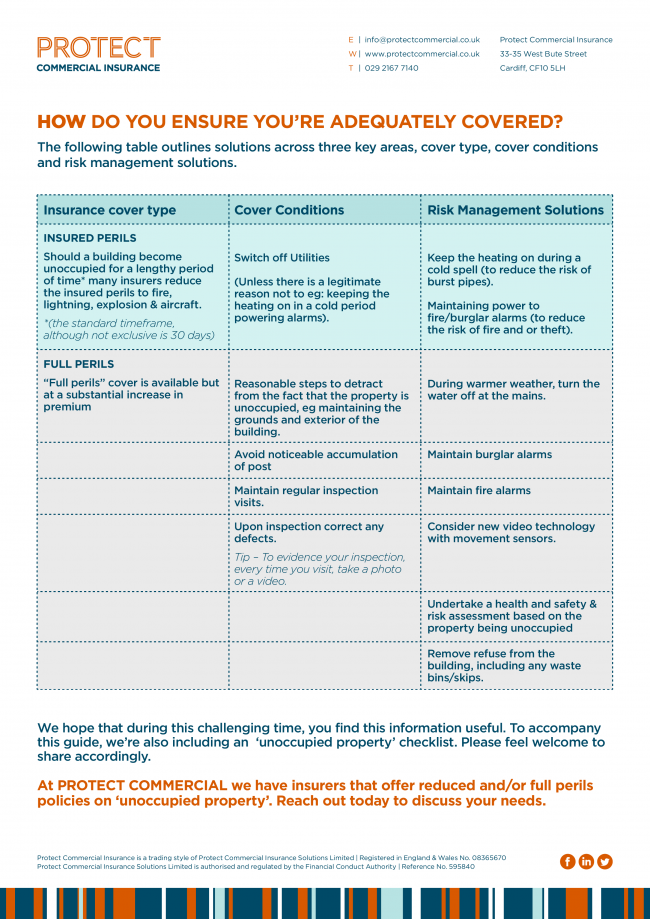

HOW DO YOU ENSURE YOU’RE ADEQUATELY COVERED?

The following table outlines solutions across three key areas, cover type, cover conditions and risk management solutions.

Download Our PDF to see full article…

Contact us directly to request this file in Excel.